33+ home mortgage interest deduction

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household.

Betterment Resources Original Content By Financial Experts

In fact by the early 1990s nearly 50 percent of all households drew on.

. Web The interest deduction is an essential and beneficial tax provision for individuals who own homes. Basement apartment in your 1800-sq-ft. Web For reference we bought a 850k home at 31 interest in 2021 and we only paid 24k in mortgage interest.

Web If your total property is rented out for the entire year you can deduct 100 of the mortgage interest paid on that property. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Web To take the mortgage interest deduction youll need to itemize.

Web ca mortgage interest deduction mortgage interest deduction limit refinance home mortgage interest deduction tax deduction refinance mortgage mortgage interest. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. It allows taxpayers to lower their overall tax burden by.

Web Third interest is deductible on only the first 1 million of debt used for acquiring constructing or substantially improving the residence 500000 if filing separately or. However higher limitations 1 million 500000 if married filing separately apply if you are deducting mortgage interest from indebtedness. Web Includes existing homes and homes under construction.

Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a. Web Standard deduction rates are as follows. The 5000 can be split between the house owners as long as the total amount claimed on all tax returns.

If you are single or married and. Web American Public never loved social welfare programs but it did not necessarily want them dismantled. Primary residence you would be allowed to deduct a third 3333 of the.

If you own a home and paid your mortgage bill you can deduct the portion of those payments that went towards paying down the interest on. Web Quick Summary. Single taxpayers and married taxpayers who file separate returns.

Itemizing only makes sense if your itemized deductions total more than the standard deduction. Web A home mortgage interest deduction is a tax deduction that helps homeowners reduce their federal tax returns by claiming interest paid on home. Homeowners who bought houses before.

12950 for tax year 2022 Married taxpayers who file. If you bought your house before December 15 2017 you can deduct the interest. However if your property.

Web You can deduct your mortgage interest only on the first 750000 of your loan. So not enough to exceed Standard deduction so it doesnt make. Web So for example if you rent out a 600-sq-ft.

Mortgage Interest Deduction Changes In 2018

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

A Guide To Mortgage Interest Deduction Quicken Loans

12 Business Expenses Worksheet In Pdf Doc

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

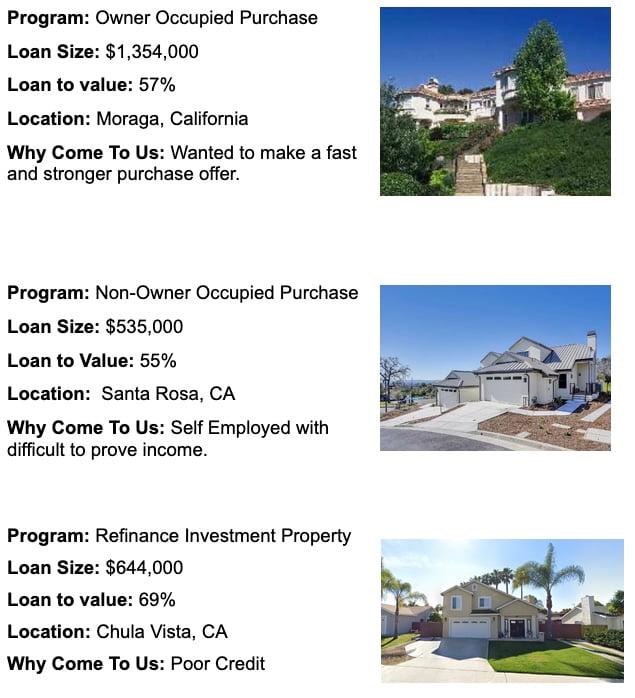

Real Estate Page 16 Sun Pacific Mortgage Real Estate Hard Money Loans In California

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

New Mortgage Interest Deduction Rules Evergreen Small Business

Valuation Of Mortgage Interest Deductibility Under Uncertainty An Option Pricing Approach Sciencedirect

The Modified Home Mortgage Interest Deduction

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Will The New Tax Law Affect My Mortgage Interest Deduction San Diego Mortgage Broker San Diego Home Loans

Tax Credit Vs Tax Deduction What Are They Features Infographics

It S Time To Gut The Mortgage Interest Deduction